The Emami Gold Coin: Iran’s Safe Haven Asset 🪙

When you hear “Emami Coin,” don’t think of a cryptocurrency. This is one of the most important physical assets in the Iranian economy—a gold coin that serves as a shield against severe economic turmoil and a barometer of public confidence.

What is the Emami Coin? (It’s Not a Cryptocurrency)

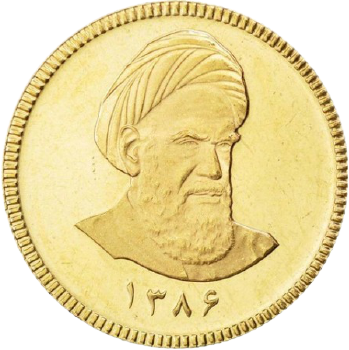

The Emami Coin is a physical gold coin officially named the “New Bahar Azadi Gold Coin.” The term “Emami” distinguishes the newer, post-revolution design featuring a portrait of Ayatollah Khomeini.

Here are the key specs:

- Weight: 8.13 grams

- Purity: 90% gold (21.6 karats)

- Minted by: The Central Bank of Iran (CBI)

It’s the most popular and liquid full-sized gold coin in Iran, functioning as the primary vehicle for gold investment in the country. For more historical context, you can visit the Wikipedia page on the Bahar Azadi Coin.

A Barometer of Iran’s Economy 🌡️

The Emami coin is far more than just a piece of gold; it’s a crucial economic indicator. Its primary role for everyday Iranians is to act as a safe-haven asset and a hedge against two persistent problems:

- Hyperinflation: Years of high inflation have drastically eroded the purchasing power of the national currency.

- Currency Devaluation: The Iranian Rial (IRR) has seen a catastrophic loss of value against major world currencies like the U.S. Dollar.

For millions of Iranians, buying Emami coins is the most accessible way to protect their life savings from being wiped out. Because of this, the daily price of the coin is watched obsessively as a real-time measure of economic fear and public sentiment.

How is the Emami Coin’s Price Determined?

The price of the Emami coin is a fascinating mix of global and local factors. It’s roughly calculated using this formula:

Global Gold Price + Free-Market USD/IRR Rate + The “Bubble”

- Global Gold Price: The foundation is the international spot price of gold, which can be tracked on sites like the World Gold Council.

- Free-Market USD/IRR Rate: The gold price is converted into Rial not using the government’s official exchange rate, but the much higher, real-world rate found in currency exchange shops. This reflects the true street value of the Rial.

- The “Bubble” (Hobab): On top of everything is a premium based on local demand. When fear is high and people are rushing to buy gold, this bubble inflates. When demand is lower, it can shrink or even turn negative.

Who Uses the Emami Coin?

The coin is deeply embedded in Iranian society:

- Ordinary Savers: The main buyers are everyday people trying to preserve their wealth.

- Investors: Speculators actively trade the coin, betting on price movements.

- Gift-Giving: It’s a traditional and highly valued gift for weddings (often as part of the mehrieh, or dowry), births, and other major celebrations.

Conclusion: More Than Just Gold

The Emami Gold Coin is a powerful symbol of economic reality. It’s not just an investment in gold; it’s a tangible expression of distrust in the national currency and a direct reflection of the immense pressures facing the Iranian economy. As of 2025, it remains a vital tool for financial survival for millions, acting as a solid store of value in a highly uncertain environment.